Precision manufacturing businesses, particularly those producing plastics, metals, and engineered components, remain at the center of strategic investment and consolidation. Over the past twelve months, despite uneven macroeconomic conditions, mergers and acquisitions activity in this segment of the U.S. manufacturing market has proven resilient. Recent landmark transactions, including Amcor’s $8.4 billion merger with Berry Global and Nippon Steel’s $14.9 billion acquisition of U.S. Steel, underscore both the scale of capital being deployed and the premiums that buyers are willing to pay for differentiated, value-added manufacturing platforms.

Objective is deeply active in the engineered components sector, with a track record that includes advising on the sale of AEM to Industrial Growth Partners and Fluid Components International (FCI) to Process Sensing Technologies (PST). These transactions not only delivered successful outcomes for our clients but also reinforced broader market trends, demonstrating the strong appetite among buyers for precision manufacturers with scale, technical differentiation, and resilient U.S.-based supply chains. For founders and shareholders of precision manufacturing companies with $25 million to $250 million in enterprise value, our focus is on maximizing value while ensuring a seamless and strategic transition.

How to Sell a Manufacturing Company: The Process for Precision Manufacturers

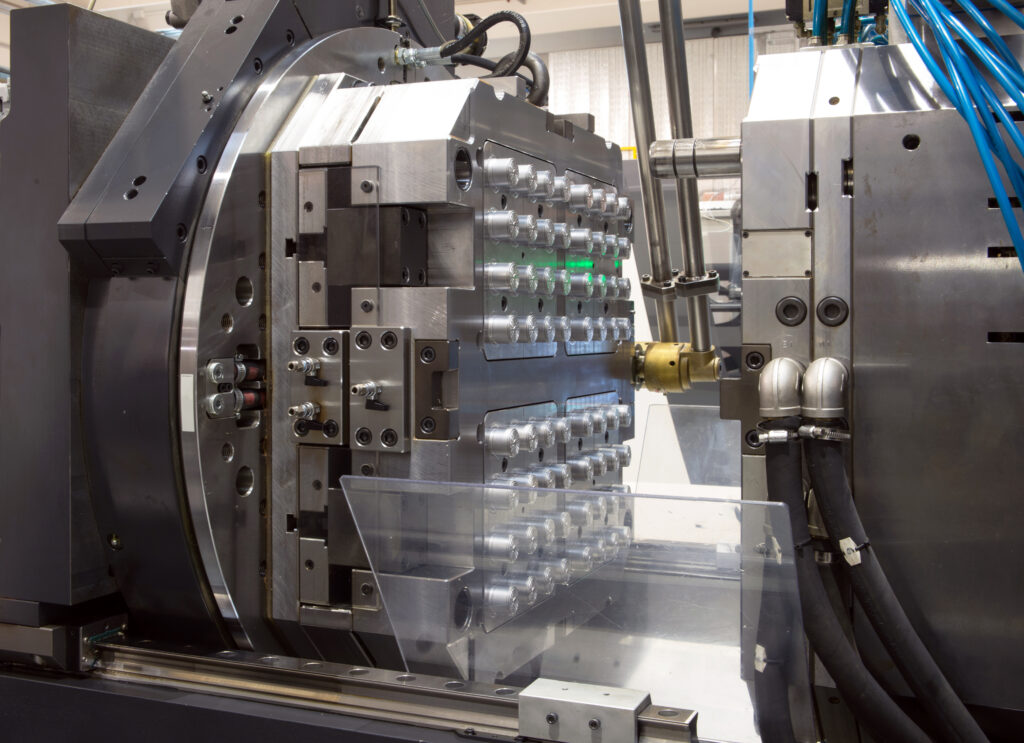

The sale of a manufacturing business is a complex undertaking that must be managed with foresight and precision. Owners must first ensure that financial and operational foundations are in order, with an emphasis on transparency, scalability, and compliance with industry standards and certifications. For precision manufacturers, credibility is often established through long-standing customer relationships, program visibility, and proven technical expertise.

From there, positioning the business in the marketplace becomes critical. Sophisticated buyers, both private equity sponsors and strategic acquirers, focus on engineered components businesses that demonstrate a clear competitive advantage, whether through proprietary processes, diversification across end-markets, or alignment with long-term growth sectors such as aerospace, medical technology, data centers, and infrastructure. A well-managed competitive process ensures that multiple buyers engage, creating the leverage necessary to maximize valuation and terms.

Market Insights: Recent M&A Trends in Selling a Manufacturing Business

While overall M&A activity across U.S. manufacturing has moderated, the engineered components sector has displayed notable resilience. In plastics, deal volume accelerated in late 2024 and early 2025, driven by both mega-deals and steady middle-market activity. Amcor’s merger with Berry Global and Novolex’s acquisition of Pactiv Evergreen (valued at $6.7 billion) are reshaping the packaging industry and illustrate the pursuit of scale by strategic buyers. These two transactions alone contributed to a nearly 194 percent increase in invested capital in plastics M&A during the first quarter of 2025 compared to the prior quarter, according to PlasticsToday. Beyond packaging, consolidation among medical plastics, automotive component molders, and engineered plastics firms has remained robust, with valuations frequently in the range of nine to ten times EBITDA. Buyers have demonstrated particular willingness to pay premiums for companies with differentiated technical capabilities, strong customer relationships, and specialized processes that serve high-growth end markets.

Metals, by contrast, experienced a decline in deal volume of roughly 30 percent year-over-year in the first half of 2025, reflecting higher interest rates, tariff uncertainty, and buyer caution. Yet this contraction has not prevented significant transactions from taking place. Nippon Steel’s $14.9 billion acquisition of U.S. Steel marked one of the largest cross-border industrial acquisitions in recent history, highlighting the enduring strategic importance of U.S.-based metal producers. Eaton’s $1.4 billion acquisition of Fibrebond at a reported 12.7 times EBITDA illustrated the high valuations that downstream, engineered fabricators can command when their offerings extend beyond commodity production. Toyota Tsusho’s $1.5 billion acquisition of Radius Recycling further reinforced the priority acquirers place on securing domestic supply chains. In specialty metals, North American Stainless’s $904 million purchase of Haynes International exemplified buyers’ pursuit of vertical integration and diversification across higher-margin product lines.

Taken together, these developments reflect a bifurcated market. Transaction volume has been constrained by macroeconomic headwinds, yet when high-quality assets are brought to market, particularly those with technical differentiation, diversified customers, and exposure to resilient end-markets, buyers have demonstrated both the appetite and the capital to transact at premium multiples.

Maximizing Value When Selling a Precision Manufacturing Business

Achieving an optimal outcome requires more than strong fundamentals; it demands foresight and preparation. Business owners who address customer concentration, succession planning, and operational scalability in advance are better positioned to achieve premium valuations. Buyers are also placing increasing emphasis on compliance with industry certifications, operational excellence, and the ability to demonstrate how a company’s products align with long-term industrial and infrastructure demand.

Equally important is the process itself. Entertaining one-off approaches from individual buyers may appear expedient, but such negotiations rarely produce the optimal outcome. A disciplined, competitive process ensures that valuation is set by the market rather than a single counterparty. This approach also provides owners with flexibility in selecting not only the best price but also the right partner for the long-term continuity of the business.

Why Partner With an M&A Advisor to Sell a Manufacturing Company

Navigating the sale of a precision manufacturing business is complex, and outcomes vary significantly depending on the quality of execution. Objective’s Manufacturing Practice focuses exclusively on advising business owners in engineered components, with a track record that includes the sales of AEM and Fluid Components International. By combining deep industry knowledge with disciplined transaction processes, Objective ensures that owners achieve both liquidity and strategic alignment with the right buyers.

Conclusion: How to Sell My Manufacturing Company for Maximum Value

The question many founders and CEOs are asking, “How do I sell my manufacturing company for its full value?” has no simple answer. Success lies in preparation, timing, and partnering with an advisor who understands the intricacies of the sector. In today’s environment, where both strategic and private equity acquirers remain highly selective, precision manufacturing businesses with scale and differentiation are commanding strong valuations. For owners, this represents an opportunity to translate years of investment and stewardship into a premium outcome.

Would you like to better understand the true market value of your precision manufacturing business? Objective offers a complimentary and confidential introductory evaluation designed to help business owners identify key strategic priorities that can maximize value in preparation for a sale. Contact us today to learn more.

Sources

- Novolex to acquire Pactiv Evergreen in $6.7 billion transaction, Packaging Dive

- Plastics Industry M&A Surges in 2025, PlasticsToday

Disclosure

This news release is for informational purposes only and does not constitute an offer, invitation or recommendation to buy, sell, subscribe for or issue any securities. While the information provided herein is believed to be accurate and reliable, Objective Capital Partners and BA Securities, LLC make no representations or warranties, expressed or implied, as to the accuracy or completeness of such information. All information contained herein is preliminary, limited and subject to completion, correction or amendment. It should not be construed as investment, legal, or tax advice and may not be reproduced or distributed to any person. Securities and investment banking services are offered through BA Securities, LLC Member FINRA, SIPC. Principals of Objective Capital are Registered Representatives of BA Securities. Objective Capital Partners and BA Securities are separate and unaffiliated entities.