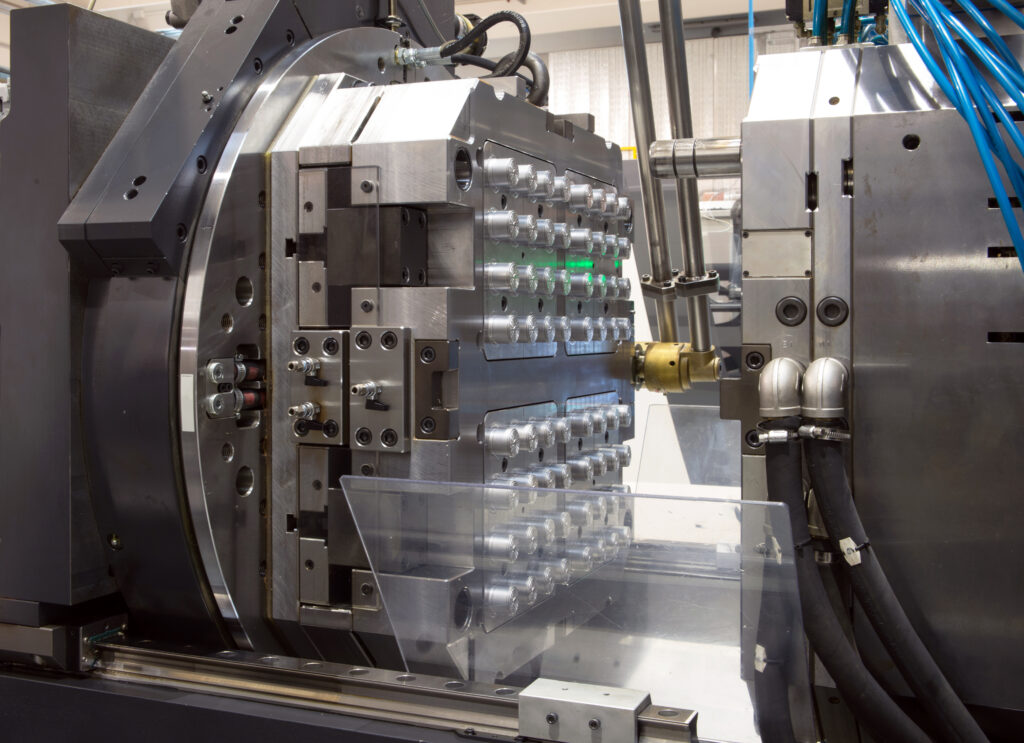

How to Sell a Precision Manufacturing Business (Plastics, Metals & Components)

Precision manufacturing businesses, particularly those producing plastics, metals, and engineered components, remain at the center of strategic investment and consolidation. Over the past twelve months, despite uneven macroeconomic conditions, mergers and acquisitions activity in this segment of the U.S. manufacturing market has proven resilient. Recent landmark transactions, including Amcor’s $8.4 billion merger with Berry Global […]

Valuation of Clinical Research Sites: What Buyers Look For in a Clinical Research Site Company

The clinical research site (CRS) sector has become one of the most active areas in life sciences M&A. With pharmaceutical companies accelerating development pipelines and competition for experienced trial sites intensifying, clinical research site businesses are increasingly viewed as strategic assets. For owners and operators, understanding the dynamics that influence valuation is essential to positioning […]

What Acquirers Are Looking for in ERP SaaS and Why Retention and Vertical AI Define “Choice Assets”

Enterprise Resource Planning (ERP) SaaS platforms are deeply embedded in customers’ operations, making them highly attractive in M&A. But what separates good assets from choice assets in today’s market? Buyers are converging on two differentiators: Customer retention – proof that the platform is sticky, mission-critical, and capable of expansion. Vertical-specific generative AI enablement – evidence […]

Objective, Investment Banking & Valuation Named Finalists for 24th Annual M&A Advisor Awards

Los Angeles, CA – September 26, 2025 – Objective, Investment Banking & Valuation is honored to announce that we have been named finalists in seven prestigious categories for the 24th Annual M&A Advisor Awards. These nominations underscore our dedication to delivering exceptional outcomes for our clients and our commitment to excellence in the mergers and […]

How to Sell a Contract Research Organization (CRO): A Strategic Guide for Founders

For founders of contract research organizations (CROs), pursuing a sale is often the most significant financial and strategic milestone of their careers. A successful transaction can unlock meaningful liquidity, establish long-term growth partnerships, and solidify the legacy of the business. Yet achieving the best possible outcome requires far more than simply finding a buyer. It […]

The Complete Data Room Checklist for Field Service Management (FSM) Business Sale: A Guide for Founders

FSM M&A Market Trends & Why 2025 is a Good Time to Prepare Founders in FSM are seeing several trends that make 2025 a favorable time to plan for a potential sale: Interest Rates Easing: Over recent months, interest rates and capital costs have begun to soften (relative to the peak in 2022-2024), making debt […]

Channing Hamlet, Dan Shea, Trever Acers, Carl Miller, and Thomas Lin Nominated for 2025 Deal Maker of The Year by Los Angeles Business Journal

Los Angeles, CA – Objective, Investment Banking & Valuation (“Objective”) is proud to announce that five of our senior leaders have been nominated for Deal Maker of the Year 2025 by the Los Angeles Business Journal in their inaugural M&A Awards program. Channing Hamlet, Dan Shea, Trever Acers, Carl Miller, and Thomas Lin were each […]

How to Choose the Best Investment Banker for ERP SaaS Company Sales: A Founder’s Guide to Selecting the Right M&A Advisor

Every ERP SaaS sale is examined through a rigorous lens: product depth, upgrade paths, and ecosystem stickiness. Because diligence is so exacting, the banker you choose must be evaluated not on reputation alone but on three tangible criteria: their reach across the buyer universe, the strategies they use to highlight value, and how well they […]

Private Equity Firms Acquiring Vertical SaaS Companies in PropTech & ConTech

PropTech and ConTech stand out as hotbeds of innovation in today’s rapidly evolving business landscape, and private equity firms have taken notice. Vertical SaaS companies in these sectors offer specialized, scalable software solutions that are transforming real estate and construction operations, making them prime targets for acquisition. Within the last year, PE and strategic buyers […]

AI Is Redefining Pharmaceutical Services and Unlocking Billions in New Value

The pharmaceutical services industry is undergoing one of the most significant transformations in its history. For decades, Contract Research Organizations (CROs), patient recruitment companies, and clinical site management organizations have been essential partners in clinical development. Yet, many of the processes that drive this sector remain manual, labor-intensive, and prone to costly bottlenecks. That is […]